The test automation market is hot.

The forecasted growth ranges from $12.6 billion in 2019 to $28.8 billion in 2024, according to Global Market Insights. In a context of digitalization with companies in search of acceleration, the race is only starting.

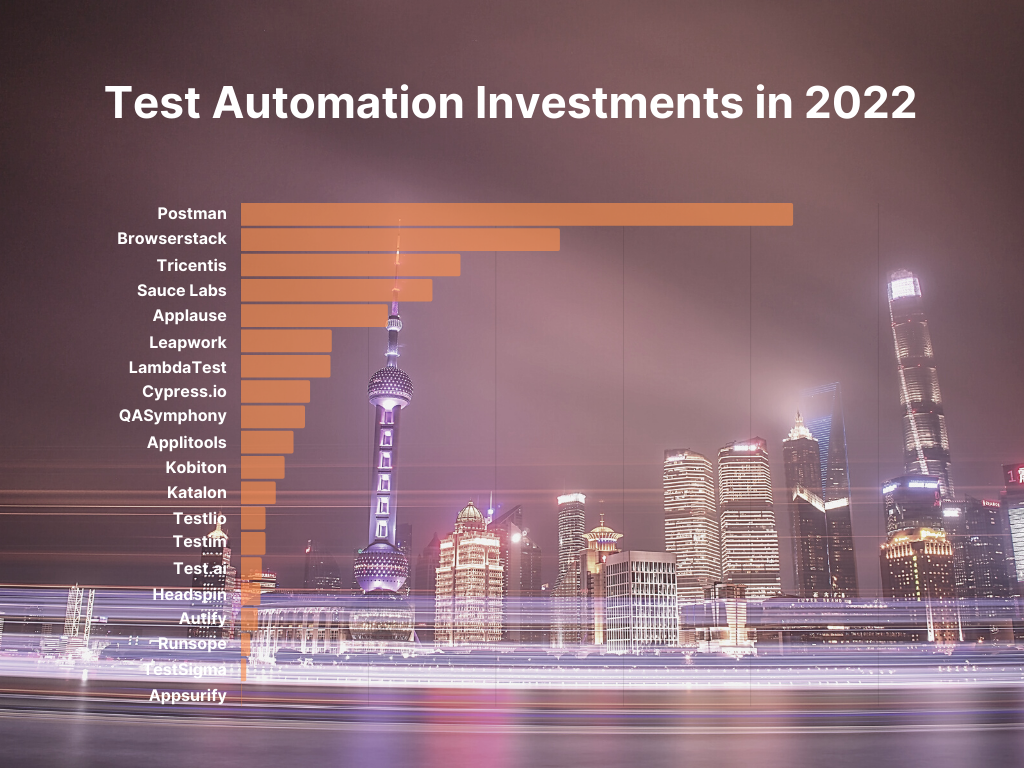

$3.6B have been injected in the software test automation market since 2016 changing the existing landscape. This article shares the top 21 investments in the test automation space in 2022 to project future evolutions.

These investments aim to allow development teams to move at the speed of business without compromising software quality, where test automation plays a significant role.

Follow me for more content on technology.

$433M: Postman to become the #1 API Marketplace

98% of Fortune 500 companies like Salesforce, Stripe, Kroger, Cisco, PayPal, and Microsoft use Postman. The company announced their public API Network as the largest API hub in the world with more than 75,000 APIs.

In June 2020, Postman raised $150M already reaching a $2B valuation. One year later, they closed a $225M deal in Series D Round to be valued at $5.6B entering in the top 10 most valued Indian startups.

Postman continues to release new capabilities at a fast pace, notably: Postman on the web, public workspaces, the Private API Network, the Public API Network, API security validations, OpenAPI validations, support for protocols.

$250M: Browserstack to ease web & mobile testing

The company – from India like Postman – focuses on providing web and mobile devices in the cloud. Their service has been increasing worldwide to simplify cross-browser and mobile testing.

They raised $250M while acquiring Nightwatch.js in 2021, the popular open-source test automation framework for Node.js (one of the fastest-growing Selenium-based tools with 1 million monthly npm installs and over 10.5k GitHub stars).

$172M: Tricentis acquisitions from Vienna

The software testing company has raised $165 million in Series B financing. The funding comes from Insight Venture Partners, a leading global private equity and venture capital firm.

Tricentis has been on fire to consolidate their offer through 7 acquisitions:

Each solution has been adding up to their offer:

- Testim is a UI-based testing

- Flood is a load testing solution

- Neotys specialized in performance test service

- TestProject is an open-source test automation platform

- Tx3 Services focuses on healthcare and life science

- Q-up provides test data management

- SpecFlow, a BDD framework for .NET

$150M: Sauce Labs, a challenger to Browserstack

Founded out of San Francisco in 2008, Sauce Labs has been making software for testing websites since it began. It expanded to Android, iOS, and MacOS apps over-time.

Sauce Labs’ offers a cloud-based platform for automated testing across 800 different browsers, operating systems, and device combinations. It had raised $70M in 2016, already counting customers like Salesforce, Lyft, Zendesk, Visa, and PayPal.

$115M: Applause to accelerate functional testing

Applause is a platform focusing on automated functional testing combined with crowd testing. The app testing firm Applause already raked in $35 million from Goldman Sachs, Scale Venture Partners, and others in a previous round.

$76.1M: Mabl to disrupt with Googlers founders

Mabl is an automated software testing platform with machine learning in its roots to detect with more proactivity errors, leaks, and visual regressions, among other glitches in websites.

Mabl was founded in Boston in 2017 by former Googlers Dan Belcher and Izzy Azeri, who had sold Stackdriver in 2014, now available natively in Google Cloud Platform. The company is now searching to accelerate.

Mabl snagged a $20 million investment from GV, Alphabet’s venture capital arm, for its AI-powered web and testing toolset. Prior to now, Mabl had raised $10 million in funding, and with another $20 million in the bank.

$71.9M: Leapwork, the automation platform moving to testing

Founded in 2015, Leapwork was built for a modern and light approach to business automation in a user-friendly way. Its product has been used for test automation with the drag-and-drop interface.

The Copenhagen-based company Leapwork got its last round at €52.6 million for its no-code software test automation platform in August 2021. It is surfing on the low-code automation adoption in part powered by skills shortage.

$70M: LambdaTest to accelerate test automation farms

LambdaTest, a well-known test execution platform that raised $45 million on March 29 in a Series C financing round. The former CEO of software testing firm Tricentis, joined the round, bringing the all-time amount raised to $70 million.

Founded in 2017, LambdaTest had earlier raised close to $25 million in funding from investment firms. Using LambdaTest’s score test execution engine, users may test their websites and apps on over 3,000 distinct combinations of devices.

$54.8M: Cypress.io to build an end-to-end testing platform

Cypress.io is a free and open source, MIT-licensed, testing tool written in JavaScript. It has a massive 37,400 Stars on Github and is used by organizations such as NASA and DHL.

The product exploded with the use of Javascript languages in modern web&app platforms, taking the opportunity of developers doing more tests by themselves.

Cypress.io raised $4M back in 2018 when focusing on front-end testing, followed by a $40M investment in 2020 to give the ability to write all forms of tests – unit, component, integration, and end-to-end.

They will also develop the Cypress Dashboard to collect results from testing of all types, providing objective quality metrics, actionable insights, and a comprehensive debugging experience to all quality stakeholders.

$50.7M: QASymphony to develop their product

Founded out of Atlanta, Georgia in 2011, QASymphony offers a range of testing and quality assurance (QA) tools to use along the software lifecycle, focusing on supporting an efficient collaboration experience.

Their QTest platform can be deployed on-premises or in the cloud is accessible to different stakeholders including development teams to organize their testing while natively providing reporting.

In May 2017, software testing platform QASymphony raised $40 million. The company claims around 400 customers—including Salesforce, Cisco, Adobe, Samsung, and Verizon—in 20 countries.

$41.8M: Applitools for AI-powered testing

Applitools is based in San Mateo, California and Ramat-Gan, Israel. The product was built with AI by design for visual testing automation and monitoring for mobile, web and native apps.

In July 2017, Applitools raised $8 million in a Series B round of funding followed by $31M in 2018. In 2021, Thomas Bravos invested $250M to accelerate their products in the DevOps ecosystem worldwide.

We noted in the ecosystem the departure of the emblematic Angie Jones in December 2021, largely involved in the test automation community. All the best Angie!

$34.2M: Kobiton to powered the mobile testing platform

Kobiton is a mobile device testing platform that accelerates the testing and delivery of mobile applications. It focuses on a flow starting from testing real devices to then create a test automation suite.

Its customers include unicorns and large companies in gaming, finance, retail, and so on. Kobiton raised $12M in september 2021 to accelerate the development of their mobile testing products.

$27M: Katalon, the backed test automation platform

Katalon provides a Studio derived from the famous Eclipse IDE for developers. It provides a test automation tool built on top of the open-source automation frameworks such as Selenium and Appium.

They target to provide a unified test automation experience for web, mobile, API and desktop application testing. Its initial release was in January 2015. Katalon raised a $1M seed at the end of 2020 followed by $27 million in Series A in June 2021.

Similarly to Cypress.io, Katalon launched their Katalon TestOps product to provide better integration with DevOps, Cloud as well as providing reporting capabilities to the entire team.

$19.5M: Testlio with to accelerate crowd testing

Testlio, from Estonia, wants to revolutionize software testing giving access to experts all over the world as well as advanced testing services on top of test automation needs.

Testlio has exceeded a $20 million annualized revenue run rate 2021 after previously raising only $7.5 million in seed and Series A capital. The company has increased revenue by 50% and employees by nearly 100% year-over-year.

In 2021, Testlio got a $12M investment to add up to their 150 internal teams, 10,000+ vetted freelance testers across 150 countries around the world.

$19.5M: Testim with a 700% Market Growth

Founded in late 2014, Testim platform, which uses artificial intelligence to speed up test authoring and dramatically reduce test maintenance.

Testim raised $10M after a impressive 700% market growth in Series B funding to address the global demand for continuous testing. Following that move, Tricentis acquired Testim in 2022.

$19.2M: Functionize to accelerate their DevOps test automation

Functionize is a pure SaaS product natively integrating with DevOps platforms like Jenkins, AWS CodePipeline, etc. It focused on simplicity with natural language processing to enable developers to type out tests in plain English.

The product also provides a range of features including API calls, two-factor authentication, cookie storage, and invisible elements. They also have internal computer vision algorithms trained for self-healing.

Functionize raises $16M in 2019 after a $2.5 million seed round in February 2018 and brought the company’s total raised to $18.2 million. In 2021, another deal followed but was not disclosed.

$16.5M: Test.ai to support the increase in mobile app testing

Test.ai is the AI-First automation framework that puts you in control of bots. Bots can navigate, see, learn, and execute test cases offering a fully automated mobile app testing solution that enables enterprises to quickly deliver better quality apps.

Test.ai raised $16.5M back in 2015.

$15M to $117M: Headspin, the mobile app testing platform

HeadSpin gives you the ability to test your user experience on any device and in any country that you choose—Android or iOS. The company has been rapidly expanding in this mobile market segment.

In 2020, Headspin announced a $60 million Series C funding. The round brings the total amount raised since inception to $117 million. But downturns with sales projection impacted its valuation, explaining its ranking here.

$13.3M: Virtuoso for customer journey’s testing

Virtuoso is a SaaS software testing platform created in 2019 combining machine learning and Robotic Process Automation (RPA) to “make testing simpler and faster”.

Virtuoso says it aims to create fully autonomous testing with little to no human interaction, enabling non-coders and coders to write automated tests in plain English.

Virtuoso raised $13.3M in Series A funding. Have a look at their journey concept and youtube channel for a concrete demonstration.

$13M: Autify for no-code & AI-powered test automation

Autify aims to reduce the burden of slow and painful testing effort building a no-code and AI-powered software testing automation platform. Chikazawa and co-founder Sam Yamashita started Autify in 2016 in San Francisco.

The three key features of Autify for web and mobile are cross-browser, multi-device testing in parallel; auto-repair with AI; and visual regression test. Autify’s AI detects any changes in the source code/UI and automatically corrects the test scenario.

Now, Autify’s software testing automation addresses the issues of a labor shortage as well as technical difficulty through its no-code platform. They raised a $10M Series A round.

$7.1M: Runscope to accelerate API development lifecycle

Runscope is a product to help developers test and debug APIs. It raised a $1.1 million seed round in early 2013. The raise followed by the launch of Radar, its flagship product for testing backend services.

A $6 million in a Series A funding round led by General Catalyst Partners, when the Runscope’s acquisition by CA Technologies happened in 2017.

$4.6M: TestSigma to support web and mobile testing

TestSigma is a cloud-based continuous testing platform for Agile and DevOps teams focusing on web and mobile applications to achieve continuous testing with a Shift-Left approach.

The company raised $400-500K back in 2020 to develop the company. An official raise of $4.6M followed in 2022 in order to accelerate TestSigma development that , like Postman, came from India.

$25K+: Appsurify for risk-based testing powered by AI

Appsurify provides an AI-based automated testing solution. The product offered by the company is TestBrain which provides a solution for risk-based manual testing, test automation, and failure elimination.It also offers DevMetrix for code analysis.

Created in 2017, Appsurify got a $25K ticket from accelerator and incubator to create the product. In August 2020, it received a new investment of a non-disclosed amount to accelerate its development.

$2B: UiPath to apply RPA in Test Automation

UiPath’s self-proclaimed mission is “to unlock human creativity and ingenuity by enabling the Fully Automated Enterprise™ and empowering workers through automation.” to deploy automations across departments.

UiPath raised $2B in total funding over 7 funding rounds, reaching a valuation of $1.1B. The company is a leader in the quickly growing Robotic Process Automation (RPA) market, raising capital from 2015, according to Crunchbase.

The product is trying to compete in Test Automation for Robotic Test Automation and RPA Testing leveraging its core capabilities. Its direct competition in RPA includes Microsoft Power Automate, Blue Prism, Automation Anywhere, SAP.

Not all the investment is going to testing. However, UiPath is one of the fastest growing technology segments with ambitions on test automation. It is necessary to keep an eye on it in the future.

The fight for moving at the speed of business is only starting

All these acquisitions are rapidly growing in a market previously seen as a cost, necessary for larger companies with a “Quality Assurance” department. But the need to accelerate software for business survival changes that equation.

Development teams need confidence to deliver accelerated software changes with confidence. Test automation is now coming as a necessity for that objective, and not anymore as an evil task performed by a third-party team.

Aside from the investments, notable acquisitions are also changing the market with Smartbear that acquired Hiptest, cucumber.io, Zephyr, Bitbar and others for more than $3.14B. Similarly, RadView acquired Shield34, Keysight bet on Eggplant for $330M.

Investments is a way to capture economies of speed by accessing a variety of services and resources much faster than with self-funding. It is a good sign, but not a predictor of good decisions, profits and product innovation in the long-run.

This additional content lets you see clear on the test automation market moves.